Weekly Market Insights

September 8, 2023 Volume 10 Issue 36

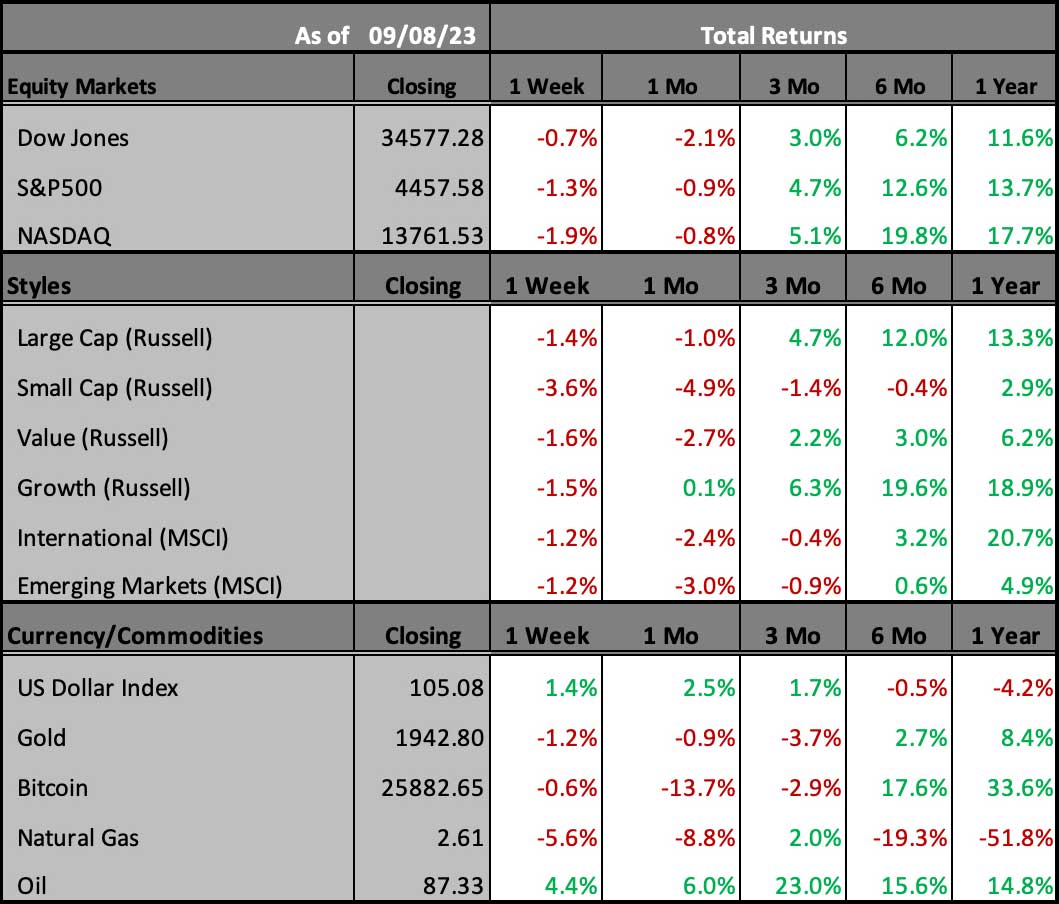

Stocks closed the first trading week of September lower, as investors worry that better-than-expected economic and employment data combined with higher gasoline prices will hamper efforts to slow inflation, forcing the Fed to keep interest rates higher for longer.

Weekly Highlights:

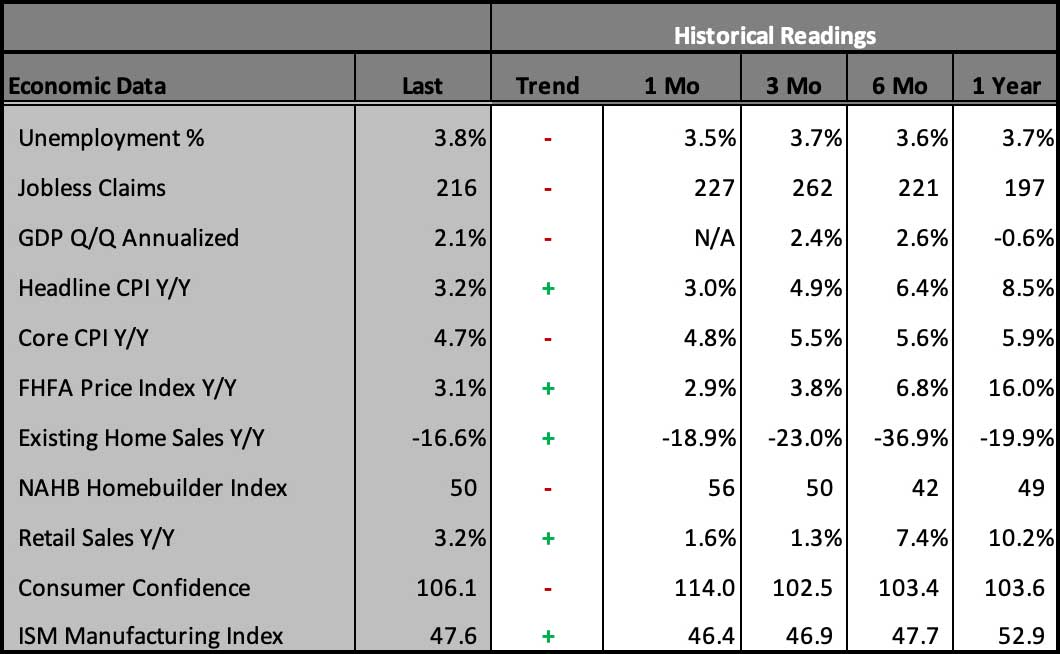

- Factory activity improved again in August but remained in contraction territory for the tenth consecutive month with the ISM Manufacturing PMI climbing to a six-month high of 47.6. Index categories were mixed, but the biggest contributor to last month’s PMI gain was the employment index which rebounded 4.1 points to 48.5, while production and supplier deliveries improved modestly. The ISM Prices Index also increased, jumping 5.8 points to 48.4, indicating a slower pace of decline in raw materials prices.

- Additionally, the ISM Services PMI increased 1.8 points to 54.5 in August, its highest level since February, and well above expectations. All index categories rose last month, led by a 4.0-point gain in the employment index to 54.7, its highest level since November 2021. The ISM Services Prices Index also rose, climbing 2.1 points to a four-month high of 58.9, indicating some firming in input prices for materials which could slow down the broader disinflation process.

- Wholesale inventories fell 0.2% in July, its second consecutive decline, and slightly below expectations. Sales jumped 0.8%, pushing the inventory-to-sales ratio down to a still historically high 1.39 months. On a y/y basis, sales were down 4.2%.

- The US trade deficit widened by $1.3 billion or 2% to $65 billion in July, below consensus estimates of an increase to $68.3 billion. Imports jumped 1.7% to $316.7 billion, led by consumer goods and capital goods, while exports rose 1.6% to $251.7 billion, led by vehicles and industrial supplies. On a y/y basis, the goods and services deficit was 21.4% lower.

- Initial claims for unemployment insurance fell by 13,000 last week to 216,000, the lowest level since February, and well below expectations. Additionally, continuing claims dropped by 40,000 to 1.679 million, as jobless claims continue to reflect a tight labor market.

The Week Ahead:

- Economic releases will include current readings on consumer and wholesale inflation, industrial production, retail sales, the NFIB small business index, and preliminary data on consumer sentiment.

Have a great weekend.

The data and commentary provided herein is for informational purposes only. No warranty is made with respect to any information provided. It is offered with the understanding that Hilltop Holdings Inc., PlainsCapital Corporation, Hilltop Securities and PlainsCapital Bank (collectively “PCB”) are not, hereby, rendering financial and/or investment advice, and use of the same does not create any relationship with PCB. This is neither an offer to sell nor a solicitation of an offer to buy any securities that may be described or referred to herein. PCB does not provide tax or legal advice. Please consult your own tax or legal advisor regarding your specific situation. Whether any of the information contained herein applies to a specific situation depends on the facts of that particular situation. Investment and estate planning and management decisions may have significant financial consequences and should be made only after consulting with professionals qualified to offer legal, accounting and taxation advice. Neither this document nor any portion of its content’s supplements, amends or modifies any account agreement with PCB. Unless otherwise noted:

*All economic release data referenced from public sources believed to be accurate. *The source of data for all charts/graphs included in this presentation is Bloomberg LP. *Figures quoted represent monthly changes (m/m) and are seasonally adjusted.