NATIONAL WAREHOUSE LENDING

............Warehouse Facilities and Lines of Credit for Mortgage Bankers

For mortgage bankers, origination is king. But increasing volume shouldn’t come at the expense of your capital. PlainsCapital’s National Warehouse Lending team can help you reduce the costs of origination with tailored facility structures, multiple incentive pricing options, and a leading-edge treasury management platform.

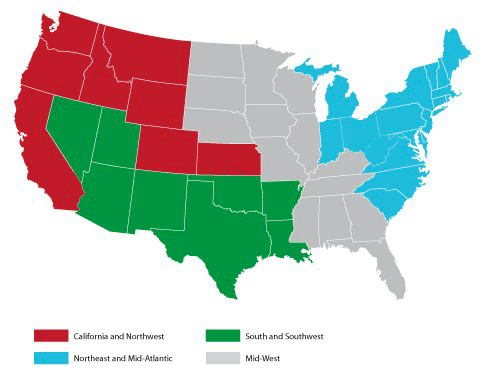

PlainsCapital Bank’s National Warehouse Lending Region Map

Warehouse Facility Eligibility

- Pricing: Base rate with incentive pricing based on volume/utilization

- Competitive transaction fees

- Line amounts $10 to $50 million

- Advance rates: 98% – 100% of net disbursed funds, not to exceed note amount

- 60-Day warehouse period

- No non-use fees

- 100+ approved investors

- $2,500 application fee (due upon acceptance of term sheet)

- Same day funding, shipping and wire transfers

- Interim construction financing options (Texas only)

Eligible Loan Types/Characteristics

- SFR 1-4 Units

- Clear-to-Close (no prior close conditions)

- FNMA/FHLMC

- FHA/VA/USDA

- Jumbo

- Second mortgage (PlainsCapital Bank must fund first mortgage to same investor)

- Minimum 600 FICO

Funding Specifics

- Street Resource Group (WLS Software System)

- Low documentation funding

- Individual and bulk funding options available

Term Sheet Requirements

- Financial statements

- Annual projections

- Trial balance reports (existing warehouse lines)

PlainsCapital Bank’s National Warehouse Lending Application (PDF)

Contact Us Today

Industry

Solutions

Get personal, individualized service from the industry experts at PlainsCapital Bank.